Technology optimized.

Risk managed.

Who We Are

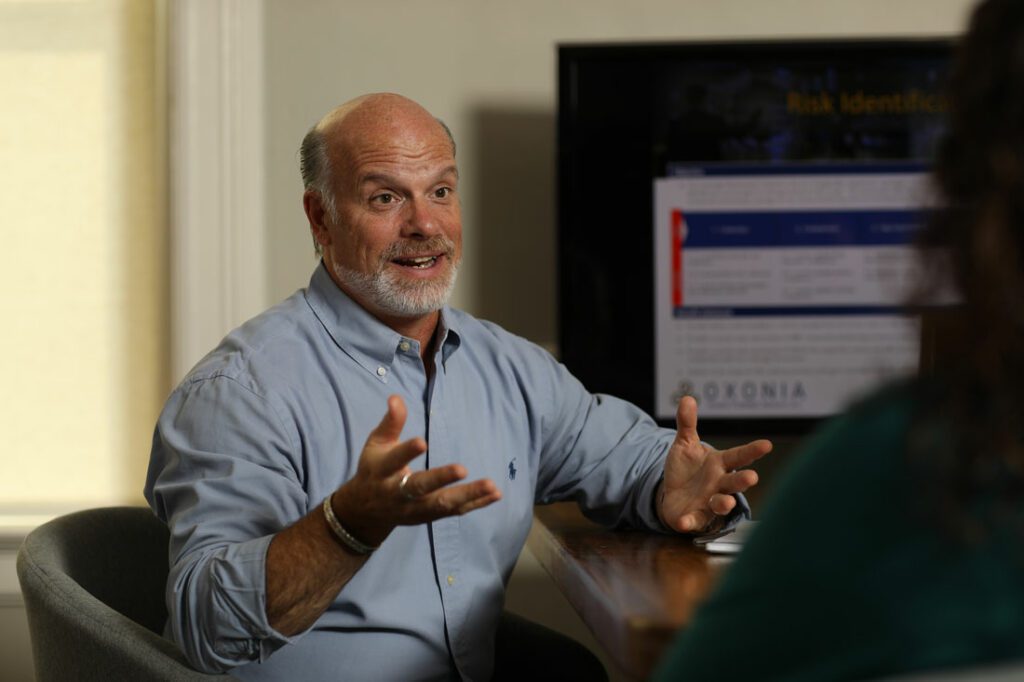

Oxonia is a team of experienced practitioners and subject matter experts applying technology and data solutions in support of financial crime compliance. We bridge the gap between the creators and beneficiaries of innovative solutions for managing risk, improving compliance and facilitating commerce.

We do so by drawing on our experience in having worked as regulators, compliance officers, technology developers and users, having “grown up” alongside the efforts to combat financial crime and the creation of technology to support it.

What We Do

Financial Crime Risk Management

Protect your organization with tailored recommendations to address compliance issues and mitigate potential risk.Training & Skills Development

Extend skill sets and capabilities by working with highly trained technical specialists to optimize technology.Professional Services

Ensure compliance and manage risk with knowledgeable consultants who can get the job done right.

Strategic Advisory

Benefit from the insight of seasoned industry experts to ensure your compliance and risk management framework supports your vision.Audit & Assurance

Demonstrate that systems, data, and processes meet the highest standards and reflect your organization’s internal policies.Benefits

Mitigate Risk & Boost Compliance

Optimize Technology

Ensure Project Success

Build a Framework for Compliance

Meet Regulatory Requirements

Why Oxonia

Partnering For Success

KPMG Canada

Compliance Analytics Limited

SightSpan

Compliance Strategy Group

Cleovici – Fintech Solutions

Case Studies

Model Governance

Oxonia’s senior advisors and consultants have extensive experience in the area of Model Governance Frameworks and Model Risk Management (MRM).

Data Governance Audit

Oxonia participated in an Assurance Review and was responsible for reviewing the client’s development of Data Quality Policy and Minimum Standards to enable the organization to effectively address regulatory instructions

Watch-list Screening Optimization

Being able to identify client risk and complete comprehensive Customer Information Profiles (CIPs) as part of Know Your Customer (KYC) compliance programs includes a number of activities and approaches